Stock option tax calculator

This calculator can be used to calculate long term capital gains LTCG and the corresponding LTCG tax liability for listed shares and units of equity oriented mutual fund schemes sold between 142018 and 3132019 both dates inclusive. Please enter your option information below to see your potential savings.

Understanding How The Stock Options Tax Works Smartasset

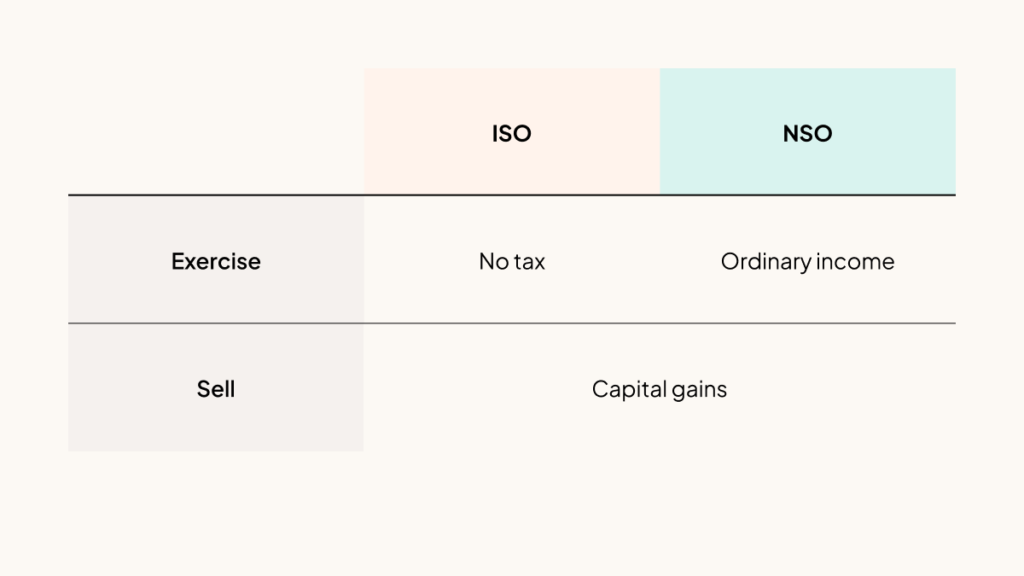

Incentive Stock Option exercises.

. We develop an incomplete-contracts model to jointly study firm boundaries and the allocation of decision rights within them. Raja I have used capital gain calculator by simple tax India on my 14 years old house in my home town sold for Rs3000000- purchase for Rs 1716092- in 2005. Your Estimated Tax Using the Assumed Par Value Method.

Long Term Capital Gains Calculator. If you exercise a non-statutory option for IBM at 150share and the current market value is 160share youll pay tax on the 10share difference. Vega for this option might be 003.

Form a Company Now. Nonqualified stock options have a pretty straightforward tax calculation eventually well build a calculator for you to use. If the total gross assets andor issued shares equal zero then please contact Franchise Tax at 302 739-3073 option 3.

Taxes are unavoidable and without planning the annual tax liability can be very uncertain. The calculator eases the complexity of the calculation by providing you with the option of factoring in the values of commission in percentage or amount. Federal Income Tax Calculator 2022 federal income tax calculator.

Finding the 1010 Perfect Cheap Paper Writing Services. Also we separately calculate the federal income taxes you will owe in the 2020 - 2021 filing season based on the Trump Tax Plan. Taxes for Non-Qualified Stock Options.

Lets say you got a grant price of 20 per share but when you exercise your stock option the stock is valued at 30 per share. Use this 1040 tax calculator to help estimate your tax bill for the current tax years rates and rules. For example a 30-day option on stock ABC with a 40 strike price and the stock exactly at 40.

Below we will dive into Alternative Minimum Tax and how it pertains to the most common trigger. In contrast ISO exercises. Effective from April 1 2020 an individual salaried taxpayer has been given the option to continue with the old tax regime and avail deductionstax exemptions such section 80C 80D deductions HRA LTA tax exemptions etc.

NYS also increases the NYS Transfer Tax from 04 to 065 on residential sales of 3 million or more and commercial sales of 2 million or more. If you are married you have the choice to file separate returns. 9 Promises from a Badass Essay Writing Service.

For example if a stock currently trades at 40 and an investor believes. Determine the total of your Delaware Franchise Tax with our Franchise Tax Calculator. Govt valuation is Rs 1993200-.

That means youve made 10 per share. The stock options may vest according to a specific schedule. For instance you may be able to exercise 250 shares per year for a total of 1000.

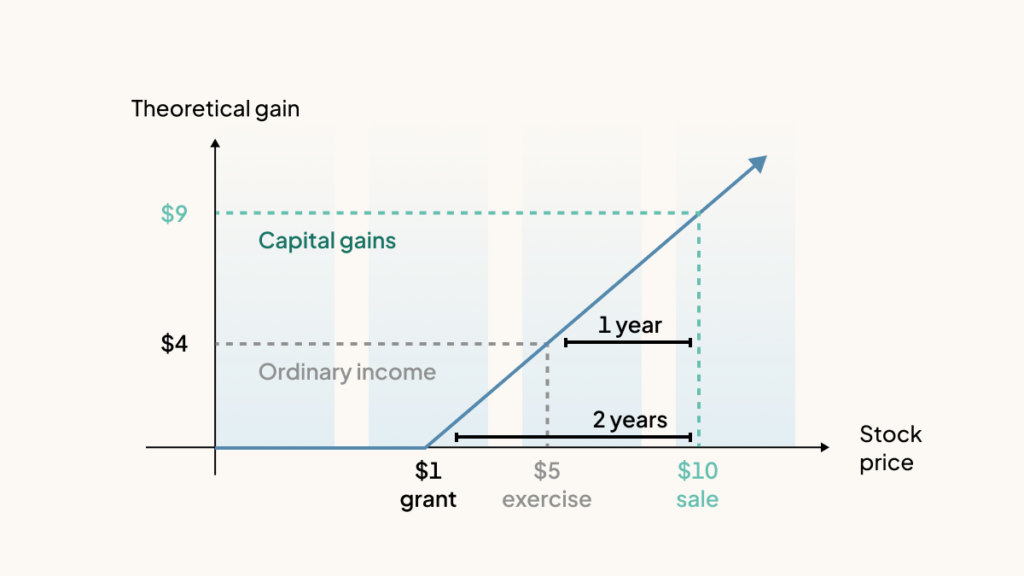

In this interview compensation expert Richard Friedman Ayco Company discusses trends in vesting schedules post-termination exercise rules and other plan features. Friedmans article on this topic. Since the spread on an NSO is treated as ordinary income when you exercise it makes a lot of sense to sell immediately.

Your household income location filing status and number of personal exemptions. Report this amount on Form 6251. What You Can Expect - 943 Get a sense of what you should and should not expect in the terms of your stock option grant.

Either an ETF or a mutual fund can be a great option. The filing status for this option is Married Filing Separately. You exercise your option to purchase the shares and you hold onto the shares.

However when you exercise a non-statutory stock option NSO youre liable for ordinary income tax on the difference between the price you paid for the stock and the current fair market value. Click here for a 2022 Federal Tax Refund Estimator. A stock fund is an excellent choice for an investor who wants to be more aggressive by using stocks but doesn.

Calculate the taxes for your corporation LLC LP or non profit today. How you report your stock option transactions depends on the type of transaction. Your 1 Best Option for Custom Assignment Service and Extras.

Options are purchased by investors when they expect the price of a stock to go up or down depending on the option type. Nonqualified Stock Options Tax Recommendations. Use the following calculator to help determine your estimated tax liability along with your average and marginal tax rates.

ISOs can flip to NSOs. Restricted stock units RSUs and stock grants are often used by companies to reward their employees with an investment in the company rather than with cash. Usually taxable Non-qualified Stock Option transactions fall into four possible categories.

You exercise your option to purchase the shares and then you sell the shares the same day. The interview is a companion to Mr. 2019 NYS updates the Mansion Tax to a progressive system with 8 individual tax brackets ranging from 1 on sales above 1m and below 2m and 39 on sales of 25 million or more.

Exercising your non-qualified stock options triggers a tax. Professional Case Study Writing Help. Unlike ISOs holders of non-qualified stock options are subject to tax at exercise if the fair market value of the stock is higher than the exercise price spread.

So if you have 100 shares youll spend 2000 but receive a value of 3000. It gives firm owners authority to delegate or centralize decision rights depending on who can best solve problems that may arise in the course of course of an uncertain production process. Or to opt for the new tax regime and forgoing approximately 70 deductions and tax exemptions.

Integration has an option value. In other words the value of the option might go up 003 if implied volatility increases one point and the value of the option might go down 003 if implied volatility decreases one point. As Close to 100 As You Will Ever Be.

Nonqualified Stock Option NSO Tax Examples. Reporting an Incentive Stock Option adjustment for the Alternative Minimum Tax If you buy and hold you will report the bargain element as income for Alternative Minimum Tax purposes. 2017 FRANCHISE TAX CALCULATOR 2018 FRANCHISE TAX CALCULATOR MS Excel format is required for use of this calculator This calculator can only be used to calculate stock that has par value.

How your stock grant is delivered to you and whether or not it is vested are the key factors. As the name implies RSUs have rules as to when they can be sold. Qualified dividends are typically dividends paid by a corporation in which you own stock or a mutual.

One of the biggest benefits to stock options is that you get to buy them at a specified price that may end up being much less than what the stock is worth on the market when the option actually vests. Option Exercise Calculator This calculator illustrates the tax benefits of exercising your stock options before IPO. The obtained results can help you decide if it is favorable for you to invest in the same stock option again or you should look for other more profitable.

Our income tax calculator calculates your federal state and local taxes based on several key inputs. Stock grants often carry restrictions as well.

How Are Dividends Taxed Overview 2021 Tax Rates Examples

Understanding How The Stock Options Tax Works Smartasset

How Stock Options Are Taxed Carta

Federal Income Tax Calculator Atlantic Union Bank

How Stock Options Are Taxed Carta

Employee Stock Options Financial Edge

Qualified Vs Non Qualified Stock Options Difference And Comparison Diffen

:max_bytes(150000):strip_icc()/dotdash_Final_Employee_Stock_Option_ESO_Sep_2020-05-8fa7cd6f867d4f82b34b0298f366c079.jpg)

Employee Stock Options Esos A Complete Guide

How Is Taxable Income Calculated How To Calculate Tax Liability

:max_bytes(150000):strip_icc()/dotdash_Final_Employee_Stock_Option_ESO_Sep_2020-03-4346254c24b54206b3dda8692d4f0f7c.jpg)

Employee Stock Options Esos A Complete Guide

Calculating Diluted Earnings Per Share

Pro Tips 4 Tax Return Errors To Avoid With Stock Options Rsus And Stock Sales

Glitjuepuunv M

How Stock Options Are Taxed Carta

Federal Income Tax Calculator Find Your Irs Refund Payment For Your Return

How Is Total Stock Compensation Expense Calculated Universal Cpa Review

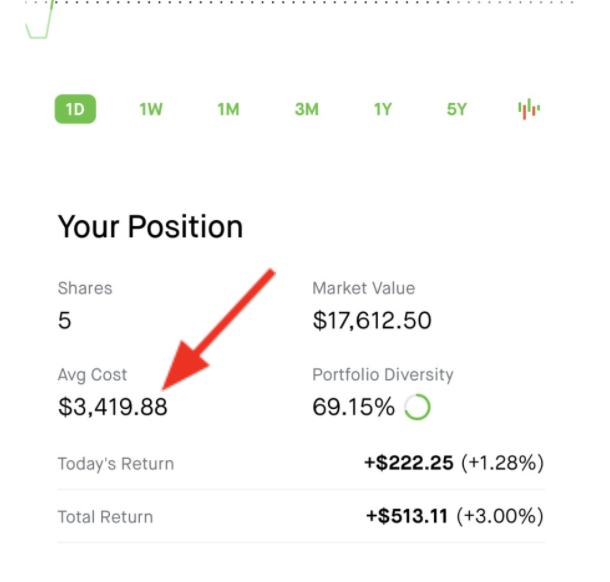

Average Cost Robinhood